Mastering Health Insurance: Total Health Costs

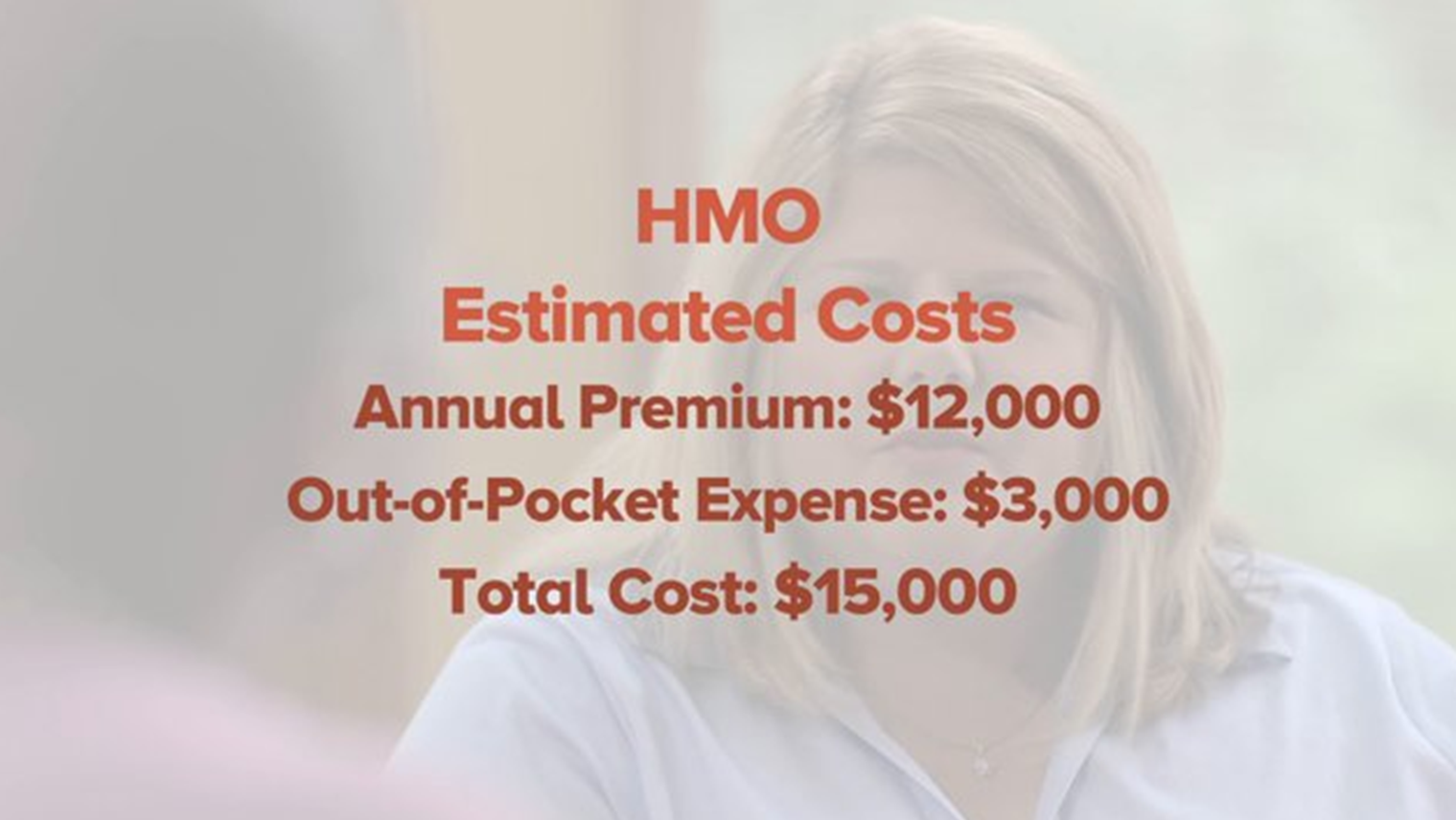

Many newly insured individuals have been surprised by the total cost of their health care coverage, especially their out-of-pocket costs. Total cost is annual premiums plus out-of-pocket expenses less any savings from a Flexible Spending Account or Health Savings Account. Here’s how to estimate it:

1) Project the use of medical care. How often does each person see a primary care provider or medical specialist? How many prescriptions do they use? A medical cost calculator will estimate out-of-pocket expenses, add annual premiums, and show a health plan’s total cost.

2) Run different scenarios. What if there is an emergency room visit? An unexpected surgery? A medical cost calculator will show how total cost might change as a result of changes in a family’s use of medical services.

3) Participate in a FSA or HSA, if possible. These funds can be used to pay for out-of-pocket expenses on a pre-tax basis. A medical cost calculator will estimate the amount of these savings and the reduction in total cost.

Look to insurance marketplaces for a medical cost calculator, as well as health plan websites and employee benefit portals. By using a calculator to understand total cost, consumers can make a more informed choice. And they won’t be surprised by the cost of their health insurance coverage.

Choosing a health plan is overwhelming. Check out ClareFolio’s Mastering Health Insurance to learn how it’s done.