Friends at the Dinner Table: Health Coverage

Health coverage dominated the debate stage this week. It was also a topic of conversation at the dinner table where friends caught up with each other on a beautiful day in Cleveland, OH.

Who was at the table? Five men. They’ve known each other since grade school and played sports together during high school. Now they enjoy a weekly basketball or golf game and a cold beer.

How is their health? Fair. Their issues include:

- Recent injury, which means months of rehabilitation.

- High blood pressure, which means prescription drugs.

- Family history of colon cancer, which means annual colonoscopies.

Where do they get health insurance? Jobs. Each has employer-based coverage through his own—or his spouse’s—job.

How is the coverage? Good. It is provided by national for-profit carriers like Aetna and United, a local BCBS plan, or regional non-profit insurers like Harvard Pilgrim and Fallon Health.

How much does it cost? 18% of GDP. These friends, some of whom own businesses that provide coverage to their employees, all understand that the current cost of health insurance is unsustainable.

What about Medicare for All? Not sure. They didn’t talk about it, but these businessmen would be glad to be rid of the administration and expense associated with providing coverage to their employees.

What’s next? Retirement. They will be eligible for Medicare when they turn 65 but, until then, they need their employer coverage.

What else? Fitbit. One friend wore one that his employer gives to every employee for free. He earns rewards that can be used to reduce the cost of his premium.

These friends are happy with their private insurers, but not with their insurance costs. They may consider solutions that exclude employers if they can keep their insurers and reduce their costs. Like in Switzerland, which spends only 12% of GDP on health care. In other words, they’re Mastering Health Insurance.

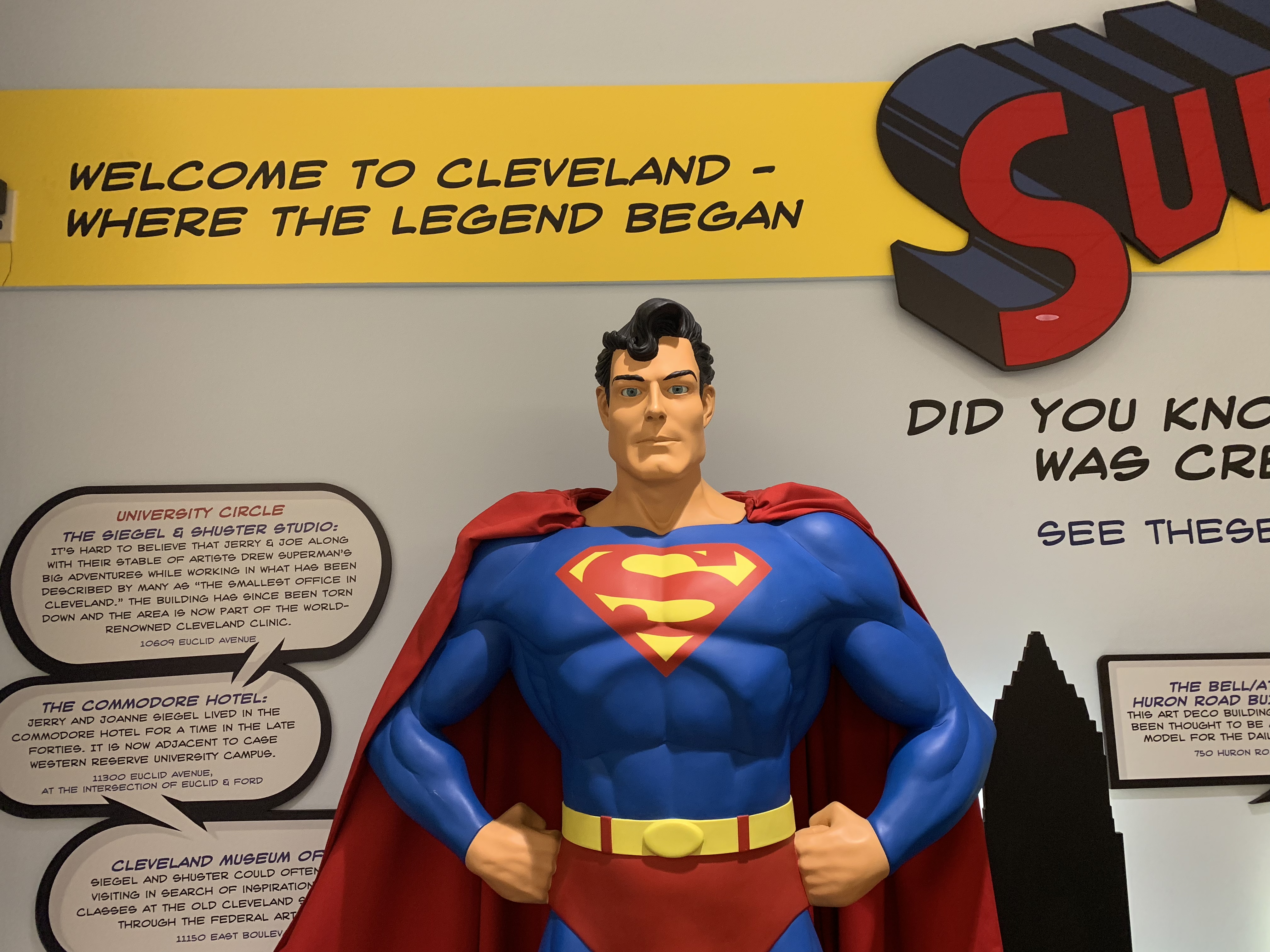

P.S., Superman was created in Cleveland, OH. Photo was taken at the airport.